The $179.4 Billion Opportunity: E-commerce Fulfilment Services Market Through 2029

- AgileIntel Editorial

- Nov 24, 2025

- 9 min read

The e-commerce fulfilment ecosystem is not just evolving; it's surging ahead, reshaping everything from supply chain logistics to consumer expectations at a global scale. As digital marketplaces accelerate, what was once a behind-the-scenes function now powers the competitive engine for market leaders. AgileIntel's latest analysis highlights the velocity of this transformation, tracking billions in value and unrivalled innovation driven by automation, omnichannel integration, and relentless consumer demand.

In this environment, industry leaders are reinventing delivery pathways, deploying smart fulfilment centres, and setting benchmarks for speed, reliability, and scalability. The current momentum is a direct result of proprietary data, which reveals how visionary strategy, regional leadership, and product specialisation are redefining best-in-class fulfilment performance, serving a consumer base that demands fast, frictionless, and digitally optimised experiences. Leaders now view fulfilment not as a cost centre but as a decisive lever for growth, market share, and customer loyalty.

Market Overview: Robust Expansion and Key Growth Metrics

The global e-commerce fulfilment services market posted a robust value of US$84.72 billion in 2021, according to AgileIntel analysis. Strong demand is expected to accelerate this growth, with the market projected to reach US$127.36 billion by 2025 and US$179.40 billion by 2029. The sector is expanding at a compelling compound annual growth rate of 8.4% from 2022 to 2029, driven by evolving consumer expectations, the adoption of technology, and a surge in digital sales activity.

This growth trajectory represents far more than simple numerical expansion. It reflects a fundamental restructuring of how goods move from manufacturer to end consumer. Fulfilment services, encompassing warehousing, order processing, QA, packaging, shipping, and returns management, have become mission-critical infrastructure for any retailer operating in the digital age. The market's expansion signals not only increased e-commerce volumes but also the professionalisation and sophistication of fulfilment operations globally.

Market Growth Visualisation (2018-2029): Understanding the Growth Arc

The global e-commerce fulfilment services market has nearly tripled over a decade, expanding from US$65.2 billion in 2018 to a projected US$179.4 billion by 2029. This trajectory reflects three critical inflection points:

Global E-commerce Fulfilment Services Market Size: 2018-2029

2020: The Pandemic Watershed (US$76.02 Billion)

The spike in 2020 marks the watershed moment when brick-and-mortar retail restrictions accelerated the shift to online channels. Supply chains suddenly required buffers, redundancy, and geographic diversification. Fulfilment providers expanded rapidly, and this growth became structural rather than temporary.

2025: Institutionalisation and Maturity (US$127.36 Billion)

By 2025, e-commerce will have become the standard for retail. Businesses now embed omnichannel fulfilment models, automation, and real-time data analytics at scale. Investment in technology and infrastructure has accelerated, with fulfilment excellence recognised as a key driver of customer loyalty and competitive advantage.

2029: Technology-Driven Future (US$179.40 Billion)

By 2029, robotics, AI-powered optimisation, autonomous vehicles, and innovative warehousing will be industry standard. Same-day delivery becomes a baseline expectation. Fulfilment transforms from a cost centre to a frontline differentiator, with only technology-enabled, scaled operators capturing market leadership.

For investors and operators, this progression validates the strategic importance of e-commerce while signalling that only those capable of deploying capital rapidly at scale will lead in 2029.

Top Service Type: Shipping Services as Growth Engine

Shipping services lead the market in terms of value, commanding the largest segment share and reflecting the critical need for timely, flexible delivery across borders and sectors. With a market size of US$33.87 billion in 2021, the shipping segment outpaces other fulfilment service offerings by optimising speed and reliability in product movement.

The dominance of shipping services reflects several interconnected dynamics.

First, last-mile delivery has become the critical differentiator in e-commerce competition. Consumers now evaluate retailers not only on product selection and price, but also on delivery speed and reliability. This has elevated shipping from a functional necessity to a competitive battlefield.

Second, the rise of third-party logistics providers (3PLs) has professionalised and standardised shipping operations, enabling smaller retailers to access world-class fulfilment capabilities without incurring the costs of building internal infrastructure.

Third, the growth of cross-border e-commerce has amplified shipping complexity and value, requiring specialised expertise in international regulations, customs clearance, and multi-carrier orchestration.

The rise of specialised shipping providers, coupled with corporate strategies to outsource shipping needs, has been instrumental in driving this growth. Companies are increasingly recognising that shipping expertise requires a dedicated focus and investment. By outsourcing to specialised providers, retailers can focus on product development, marketing, and customer experience, while letting logistics experts handle the intricate choreography of moving goods efficiently and cost-effectively. This market segmentation has created a thriving ecosystem where shipping service providers compete on speed, cost, sustainability, and innovation.

Top Product Type: Clothing and Footwear Dominate Fulfilment Activity

The clothing and footwear category is the predominant driver of fulfilment volume and value, accounting for 27% of the market share and generating US$22.56 billion in revenue for 2021. E-commerce's convenience, vast assortment, and competitive prices have enticed consumers to embrace online channels for apparel shopping with unprecedented enthusiasm.

Market Size by Top Service Type in 2021

This segment's leadership is rooted in several fundamental advantages. Apparel and footwear are ideal e-commerce categories, as relatively standardised sizing systems exist, return policies can accommodate fit adjustments, and consumer acceptance of buying clothing online has reached a critical mass. Unlike perishable goods or heavy machinery, apparel ships efficiently and can tolerate moderate delays without degradation. Furthermore, fashion e-commerce benefits from powerful network effects: online marketplaces create communities, influencers drive trend discovery, and peer reviews build confidence in purchase decisions.

The clothing and footwear segment experienced accelerated adoption during the pandemic, establishing online shopping as the preferred mode of purchase for numerous customers worldwide. During lockdowns, apparel retail shifted almost entirely online. Consumers who previously preferred in-store shopping experienced the convenience of home delivery and the efficiency of online returns. Many never reverted to traditional retail patterns, even as stores reopened. This cohort shift represents a permanent expansion of the e-commerce addressable market for apparel, and fulfilment providers have scaled operations accordingly.

Moreover, the fast-fashion business model amplifies demand for fulfilment. Brands like Shein, H&M, and Zara operate on rapid inventory turnover with frequent new arrivals. This requires fulfilment partners capable of handling volatile and unpredictable demand with short lead times. The market has responded by developing specialised capabilities for high-velocity, low-cost fulfilment tailored to this segment.

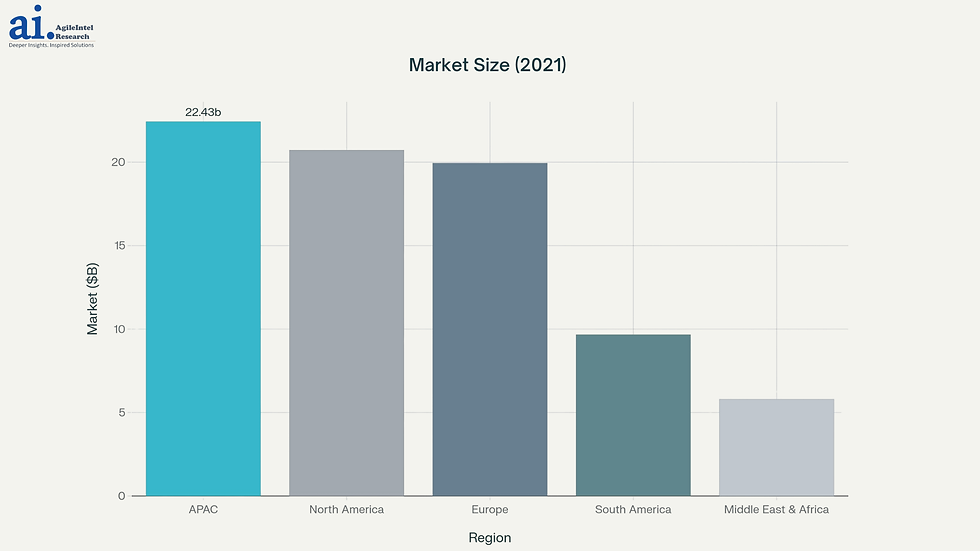

Regional Leadership: Asia-Pacific (APAC) as the Market Frontrunner

The Asia-Pacific (APAC) region is the top region by market share, accounting for more than 26% of the global fulfilment services market in 2021, with a value of US$22.43 billion. APAC's surge is attributed to the rapid growth of digital marketplaces, high internet penetration, and the region's dominant role in global merchandising. Emerging economies within the APAC region are driving e-commerce adoption, making it the epicentre for fulfilment innovation and investment.

Market Size by Top Region in 2021

The APAC region's preeminence reflects structural advantages that are likely to persist for decades. The combination of a large population and rising middle-class purchasing power creates the world's most extensive potential consumer base for online commerce. Countries like India, Indonesia, and the Philippines are experiencing explosive growth in smartphone adoption and internet access, converting vast populations into digital consumers almost overnight. Meanwhile, China's e-commerce infrastructure has matured into a sophisticated, technology-driven ecosystem that sets global benchmarks. Alibaba, JD.com, and emerging players have invested billions in fulfilment innovation, creating a competitive hothouse where best practices emerge rapidly and scale.

Additionally, APAC serves as a critical manufacturing and sourcing hub. With production concentrated across China, Vietnam, Bangladesh, and India, fulfilment providers in the region benefit from proximity to their supply origins, enabling efficient order fulfilment for goods destined for regional consumers and international buyers. The region's port infrastructure and logistics networks have been optimised through decades of trade-focused investment, creating a natural advantage for fulfilment operations.

Investment capital has followed opportunity. Private equity, venture capital, and strategic corporate investors have invested substantial resources in APAC logistics infrastructure, resulting in the development of world-class fulfilment facilities and technology platforms. This virtuous cycle of investment, innovation, and growth has positioned the APAC region as the undisputed leader in the fulfilment market.

Drivers and Market Dynamics: Technology, Consumer Behaviour, and Trade

Multiple drivers are reshaping the competitive landscape and determining which players will lead in the next decade:

Technology Integration: The Automation Imperative

Automation, robotics, and augmented reality have become integral to warehouse and shipping operations, enhancing accuracy and reducing turnaround times. Modern fulfilment centres now utilise robotic arms for picking, automated sortation systems for routing packages, and AI-powered systems for demand forecasting. These technologies directly reduce labour costs, which account for 50-60% of traditional fulfilment expenses. Beyond cost reduction, automation enhances accuracy: robotic picking systems achieve error rates of less than 0.1%, compared to 2-3% for manual operations. This translates to fewer returns, higher customer satisfaction, and improved margins. Investment in automation technology has become a table-stakes requirement for large-scale fulfilment operators.

Changing Consumer Preferences: Speed and Convenience as Baseline Expectations

High internet and smartphone penetration contribute to the proliferation of online shopping, as well as heightened expectations for delivery speed and convenience. Consumers in developed markets now expect next-day or same-day delivery.

In emerging markets, as e-commerce adoption accelerates, consumers rapidly adopt these expectations. This creates relentless pressure on fulfilment providers to compress delivery windows while maintaining service levels. Meeting these expectations requires a dense network of fulfilment centres strategically positioned near population centres, necessitating significant capital deployment.

Cross-Border E-commerce: Unlocking Global Consumer Access

Favourable trade agreements and free-trade zones are expanding the reach and scope of fulfilment providers, thereby opening up new market opportunities. Trade agreements that reduce tariffs and simplify customs procedures make cross-border e-commerce economically viable for a broader range of categories and price points. Free-trade zones strategically located in hubs like Singapore, Dubai, and Hong Kong create efficient consolidation and distribution points for international shipments.

Fulfilment providers that master cross-border logistics can serve customers globally while maintaining cost efficiency, creating competitive advantages that translate into market share gains.

Pandemic Effects and Structural Shifts

COVID-19 has permanently shifted consumer buying patterns towards e-commerce, prompting retailers to reinforce their supply chain agility and fulfilment resilience. Even as pandemic restrictions lifted, online commerce volumes remained elevated. Companies learned that distributed fulfilment networks and diversified supplier bases reduce disruption risk. This recognition has driven sustained investment in fulfilment infrastructure beyond crisis levels, establishing a permanently expanded market baseline.

Industry Challenges: Bottlenecks and Emerging Solutions

Despite remarkable growth, challenges persist and require strategic attention:

Shipping Delays and Last-Mile Economics

Location constraints and slow delivery remain top reasons for online cart abandonment and customer discontent. Last-mile delivery, from the fulfilment centre to the customer, represents 50% of total shipping costs but generates disproportionate customer frustration when delayed. Rural areas and remote locations present particular challenges: serving these customers economically while meeting speed expectations requires innovative approaches, such as crowdsourced delivery or establishing consolidation hubs.

Urban Fulfilment and Real Estate Constraints

With most sales originating in urban areas, the proximity and operational efficiency of fulfilment centres near major cities are crucial. Urban real estate costs have escalated significantly, squeezing margins for fulfilment operators. Forward-thinking companies are deploying micro-fulfilment centres in urban cores, utilising vertical space and automation to serve dense populations efficiently. Others are exploring nested networks where extensive regional facilities feed smaller satellite locations, balancing cost and speed.

Labour Market Pressures and Pandemic Disruptions

While logistics have rebounded, labour shortages and unpredictable global shipping timelines continue to impact market performance. Fulfilment work is physically demanding and often seasonal, making workforce recruitment and retention challenging. Supply chain disruptions, whether caused by port congestion or geopolitical tensions, create unpredictable delays that frustrate customers and strain operations. Forward-thinking companies are investing in automation to reduce labour dependency and building redundancy into networks to mitigate disruption risk.

Competitive Landscape and Strategic Imperatives

Global players like Amazon, FedEx, and Shipfusion are pivotal in shaping competitive dynamics, leveraging advanced fulfilment technologies and expansive networks to capture market share. Amazon's Fulfilment by Amazon (FBA) service has established a template for integrated e-commerce fulfilment, enabling sellers to outsource logistics while focusing on product development and marketing. FedEx and UPS have evolved from traditional shipping companies to integrated logistics providers, offering comprehensive end-to-end fulfilment solutions. Specialised players, such as Shipfusion and 3PL providers, have carved out significant niches by providing tailored solutions for mid-market retailers and specific verticals.

Strategic investments in automation and cross-border capabilities are driving consolidation and innovation, positioning leading providers for sustained growth and success. The market is consolidating around scale, as companies with global networks, technology platforms, and financial resources to invest in automation are gaining market share from smaller, regional players. Successful strategies emphasise omnichannel capabilities, data-driven operations, and customer-centric service models that go beyond basic logistics to offer strategic partnerships.

Conclusion: Seizing the Strategic Moment

The global e-commerce fulfilment services market is entering an era marked by rapid growth, technology-driven transformation, and strategic reorientation. With APAC, shipping services, and clothing/footwear segments demonstrating outsized influence, industry leaders must focus on operational excellence and responsiveness to capture emerging opportunities. The market's 8.4% CAGR through 2029 represents not only growth but also a fundamental reshaping of retail infrastructure and a competitive advantage.

For companies operating in this space, the imperative is clear: invest in technology, build geographically diverse networks, develop specialised capabilities for high-growth segments, and cultivate organisational agility. The winners in 2029 will not be those who optimised yesterday's fulfilment model, but rather those who anticipate tomorrow's consumer expectations and position their operations accordingly. The time to act is now.

This analysis represents a curated snapshot of AgileIntel's comprehensive market intelligence. The full dataset encompasses detailed regional breakdowns, product category segmentation, quarterly performance trajectories, and scenario-based forecasting models. To access the full dataset, connect with AgileIntel.

Comments