The Rise of Social Commerce: A Global Sector Advancing to $7.45 Trillion by 2030

- AgileIntel Editorial

- Nov 19, 2025

- 7 min read

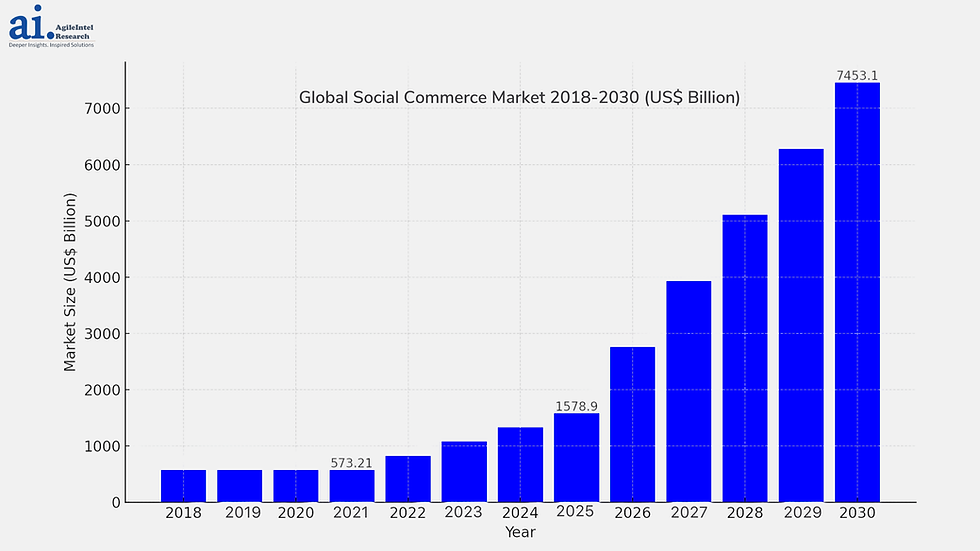

Social commerce is reshaping the global retail landscape at unprecedented speed, driven by the deep integration of content, community engagement, and seamless digital transactions. Based on AgileIntel’s proprietary dataset, the global social commerce market stood at US$573.21 billion in 2021 and is projected to grow to US$1,578.90 billion by 2025, on track to reach US$7,453.10 billion by 2030. This trajectory reflects a decade-long structural transition in which digital influence and peer-led discovery directly convert into commerce at scale.

Social commerce integrates interaction, content, and transaction within unified digital ecosystems. It transforms consumer engagement from linear journeys into continuous, data-driven experiences. Asia-Pacific (APAC) remains the dominant region, accounting for approximately 69% of total market value in 2021 and retaining its leadership through 2030.

This AgileIntel report highlights the structural drivers, leading category shifts, key platform innovations, and regional forces shaping the sector’s long-term outlook. For access to the complete analysis, please get in touch with AgileIntel.

Market Overview

Social commerce has evolved from an auxiliary channel into a core pillar of digital retail strategy. It blends the discovery-led nature of social media with the transactional efficiency of e-commerce. Our AgileIntel perspective frames this as an ecosystem shift rather than a traditional channel migration. Consumers are not merely moving from physical to digital environments. They are reconfiguring how trust, authenticity, and convenience influence decision-making.

The model’s strength lies in its ability to embed commerce within daily social interactions. The retail experience now takes place within environments designed initially for conversation and community building. For enterprises, this convergence presents both opportunities and complexities. It demands a reconfiguration of customer acquisition, brand storytelling, and technology investment strategies.

Market Size and Growth Outlook

The quantitative progression in the dataset highlights a period of rapid and sustained growth.

Global Social Commerce Market Size (US$ Billion)

Between 2021 and 2030, the market is expected to expand more than twelvefold. This acceleration reflects increasing consumer comfort with digital transactions, the proliferation of mobile-first platforms, and the growing economic significance of creator-driven content.

The CAGR embedded in the dataset signifies not only market growth but also ecosystem maturity. Platforms have evolved beyond experimentation into integrated commercial infrastructures that capture, analyse, and act upon consumer intent in real-time.

Regional Insight: The Asia-Pacific Imperative

The AgileIntel data identifies the Asia-Pacific (APAC) region as the largest and most dynamic within the global social commerce market. The region accounted for nearly 69% of the total market value in 2021, driven primarily by China, India, and other high-growth digital economies.

China has developed a deeply integrated model in which messaging, payments, and retail coexist within super-app ecosystems. WeChat, Taobao, and other platforms exemplify how technological scale and consumer trust combine to sustain commercial engagement. In India, mobile affordability, vernacular content, and short-form video platforms have democratized participation, enabling small and medium enterprises to reach national audiences.

Within this preview, APAC remains the standout region that anchors the global growth narrative. The area continues to set the benchmark for innovation in social retail integration.

Drivers Behind Growth

AgileIntel identifies multiple structural drivers contributing to the rapid ascent of social commerce. These can be grouped under application diversification, technology enablement, ecosystem integration, behavioural shifts, and regulatory facilitation.

Application Diversification

Social commerce adoption is expanding across a broad spectrum of industries. Initially concentrated in fashion and beauty, the model now encompasses a wider range of products, including food and beverage, consumer electronics, home décor, and lifestyle products.

This diversification extends consumer engagement opportunities and stabilises revenue streams. Each category leverages the unique strengths of social commerce: visual storytelling, peer validation, and influencer-led recommendations. The expansion into functional categories, such as electronics, demonstrates the model’s evolution from trend-based to utility-based commerce.

Technology Enablement

Advanced analytics, artificial intelligence, and machine learning constitute the operational backbone of modern social commerce. Algorithms personalise product discovery, recommend timing for engagement, and predict purchase intent with increasing accuracy.

These technologies convert user interaction data into predictive behavioural insights. The process enhances conversion efficiency, reduces acquisition costs, and delivers personalised experiences at a large scale. The commercial outcome is a closed feedback loop in which data informs engagement, engagement drives sales, and sales generate richer data for further optimisation.

Platform Ecosystem Integration

The AgileIntel report emphasises the unification of social, commercial, and financial infrastructures within a single digital environment. Payment systems, logistics networks, and customer relationship management tools are embedded directly within social platforms.

This integration eliminates friction across the purchase journey. Consumers discover, evaluate, and transact without platform migration. For enterprises, it enables unified analytics and real-time inventory synchronisation. The result is a seamless ecosystem that supports rapid scaling and a consistent brand experience.

Influencer and Peer-Trust Economy

Trust remains the central differentiator in social commerce. Micro- and nano-influencers play a critical role in building authenticity. Their communities are characterised by high engagement and perceived credibility, which directly translates into higher conversion rates.

The peer-validation loop creates network effects that simultaneously amplify visibility and trust. As platforms refine algorithmic targeting, this model becomes increasingly efficient and measurable.

Behavioral Permanence

The pandemic accelerated adoption, but the sustained growth observed in the dataset confirms that behavioural change has become a structural shift. Consumers who began transacting online during lockdowns have retained these habits.

Comfort with digital wallets, live product demonstrations, and social platform checkouts has redefined the standards of convenience. This permanence has established a stable foundation for continued expansion beyond the pandemic period.

APAC Leadership and Localisation

APAC’s continued dominance reinforces the importance of localisation in global strategy. Cultural fluency, tailored engagement models, and adaptive payment systems drive success within this region.

As Western and emerging-market players adopt APAC-style live shopping and gamified engagement, localisation remains critical. The ability to deliver contextually relevant experiences without compromising scale is emerging as a key competitive advantage.

Regulatory and Infrastructure Support

Digital payment frameworks, consumer protection policies, and data privacy standards have strengthened platform credibility. Regulatory evolution, particularly in major Asian markets, has reduced transaction risk and increased consumer trust.

Stable regulatory environments encourage innovation and formalise participation by smaller merchants. This has created a more transparent and scalable digital marketplace, contributing directly to market expansion.

Product Landscape

According to the AgileIntel dataset, personal and beauty care is the leading product segment, representing approximately 23% of market share in 2021. Its dominance reflects the category’s alignment with visual and experiential content formats that perform strongly on social platforms.

Global Social Commerce Market by Product Type (2021, Top Category Only)

In this excerpt, we focus only on the leading category to illustrate the structural importance of beauty and personal care within social commerce ecosystems.

Beauty and personal care products rely heavily on visual validation, influencer demonstrations, and peer recommendations. The sector’s engagement intensity and high repeat purchase frequency make it ideally suited to social-commerce dynamics. Apparel and accessories follow closely, driven by virtual try-on features, live styling sessions, and augmented-reality previews that enhance confidence and reduce returns.

Technology as a Structural Pillar

Technology has transitioned from an enabler to an intrinsic structural component of retail. Artificial intelligence, data analytics, and automation have become essential for understanding and influencing consumer decisions.

Three dimensions define this transformation:

Discovery is data-led. Algorithms identify and surface relevant products, shaping awareness before intent formation.

Trust is peer-mediated. Credibility now arises from community consensus rather than corporate messaging.

Conversion is automated. Integrated analytics deliver contextual offers at the precise moment of engagement.

This fusion creates a self-optimising ecosystem that continuously refines itself through data feedback. It represents a fundamental redesign of the retail value chain.

The B2C Dominance

The dataset confirms the Business-to-Consumer (B2C) model as the most significant and fastest-growing segment. It accounted for more than half of global revenue in 2021 and is expected to maintain its leadership through 2030.

B2C social commerce leverages authenticity, immediacy, and emotional connection to drive sales. It converts engagement into economic activity through influencer-led storytelling and personalised digital experiences. The scalability and relatability of B2C interactions position it as the dominant commercial configuration within the sector.

Long-Term Market Trajectory

To illustrate the decade-long evolution of the global market, the following visualisation aggregates AgileIntel data from 2018 to 2030.

The consistent upward trajectory reflects both the underlying technological maturity and the increasing normalisation of social platforms as trusted retail environments. The dataset projects steady growth acceleration between 2025 and 2030 as monetisation models stabilise and consumer engagement intensifies.

Competitive Landscape

The competitive field consists of both established technology conglomerates and emerging niche platforms. The AgileIntel report lists major players such as Facebook, Pinterest, PayPal, Poshmark, Reddit, Sina, Taobao, and Twitter.

Competition is increasingly defined by ecosystem integration and data ownership rather than product catalogue size. The ability to connect content, payments, and fulfilment under a unified experience is now the primary determinant of strategic advantage.

Innovation focuses on native storefronts, real-time shoppable video, and creator monetisation frameworks. Firms that deliver consistent personalisation while maintaining data integrity will lead the next phase of consolidation and growth.

Strategic Themes Toward 2030

Four macro themes emerge from the AgileIntel insights:

Convergence of Content, Commerce, and Community: Social interaction has become the nucleus of digital retail. Engagement is now the foundation of conversion.

Expansion of Live and Video Commerce: Real-time interaction replicates the immediacy of physical retail within digital ecosystems, enhancing trust and impulse buying.

Sustainability and Ethical Transparency: Environmental and ethical considerations are gaining prominence in consumer decision-making. Brands that demonstrate responsibility through transparent communication will outperform peers.

Decentralisation of Creator Networks: Individual creators are evolving into commercial entities with their own distribution networks. Platforms that enable and monetise this decentralisation will secure a lasting competitive advantage.

These structural currents indicate a marketplace characterised by inclusivity, personalisation, and co-creation between brands and consumers.

Strategic Imperatives for Enterprises

To capture value within this expanding ecosystem, organisations must adopt a portfolio of interrelated strategies that align with their objectives.

Ecosystem Agility. Integrate marketing, commerce, and customer data systems to ensure unified visibility across the consumer journey.

Creator Empowerment. Build partnerships with micro-influencers and content creators to enhance authenticity and expand reach.

Responsible Data Use. Implement transparent governance for AI and data analytics to strike a balance between personalisation and privacy.

Localised Execution. Adapt content, language, and payment frameworks to reflect cultural and regional preferences, following the APAC model of contextual relevance.

These imperatives emphasise operational discipline and innovation capability as prerequisites for sustainable participation in the next growth phase of the market.

Conclusion

The AgileIntel dataset provides a clear and consistent narrative. Social commerce is reshaping the global retail sector from both a structural and behavioural perspective. The market expands from US$573.21 billion in 2021 to an estimated US$7,453.10 billion by 2030, confirming its transition from an emergent trend to a mainstream economic driver.

The Asia-Pacific region remains the epicentre of innovation and scale, setting the standard for integrated platform ecosystems. The convergence of content, technology, and community is redefining competitive advantage, with authenticity and agility emerging as the decisive differentiators.

For global enterprises, social commerce represents not only a commercial opportunity but also a strategic inflexion point. The organisations that invest in data intelligence, local relevance, and ethical engagement will define the next era of consumer interaction.

For access to the full report, including comprehensive regional insights and detailed segment analysis, please contact AgileIntel.

Comments